A little-known change tucked into the Inflation Reduction Act provides allows large-scale clean electricity technologies like nuclear, geothermal, hydro, and long-duration energy storage to earn tax credits before project completion.

Qualified Progress Expenditures (QPE) enable eligible projects to earn the investment tax credit while under construction even before the project is complete. This is a significant benefit for large-budget projects like nuclear which can take five to ten years to complete construction.

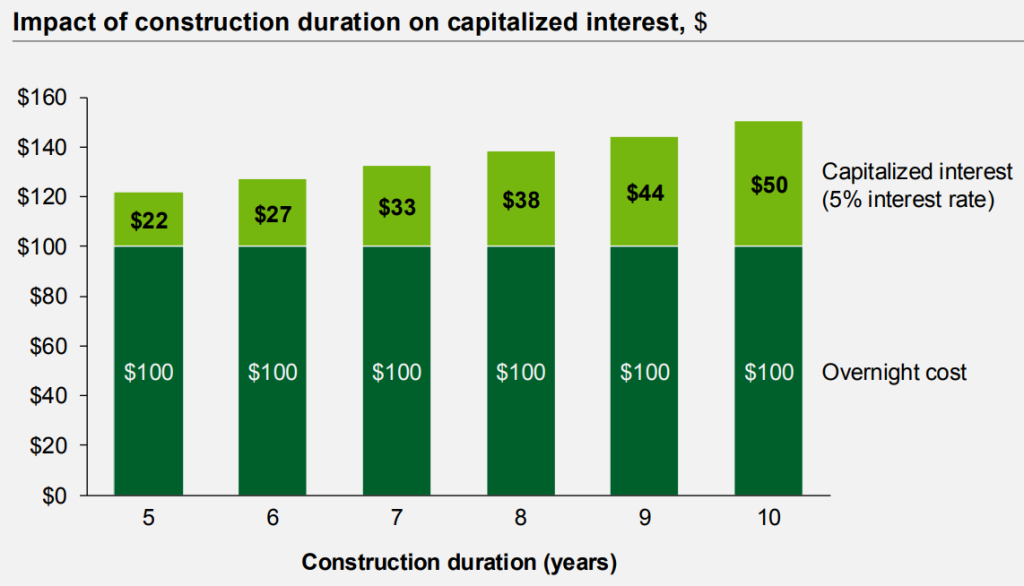

Typically, project sponsors need to take out huge loans to finance the construction of the plant. Paying back the loan with interest can dramatically increase the overall cost of a project. DOE’s Advanced Nuclear Liftoff report demonstrates how even a 5-year construction period can add an additional 22% in capitalized interest to the overall capital cost of the project.

Given the often large budgets in the billions of dollars, the lengthy construction time, and the fact that projects typically don’t earn any revenue until completed, anything that can reduce the size or duration of a construction loan can add up to major savings.

Other details guiding the use of QPE:

- Projects must be anticipated to take more than two years to construct and have a useful life of more than seven years. This means projects with a shorter construction period like wind, solar, and battery storage likely would not benefit from QPE.

- Public power and other not-for-profit organizations are eligible for QPE and elective pay tax credits. That means entities like the Tennessee Valley Authority and Energy Northwest could make use of QPEs for new nuclear projects.

- Tax credits earned via QPE are not eligible for credit transfer. The entity earning QPE credits must either make full use of them or carry them forward. However – eligible projects can still be constructed by a third-party. See regulatory details below.

- Credits earned via QPE are clawed back if the project is abandoned. Project sponsors will need to cover this risk under insurance or some other type of product.

- Regulations guiding QPE already exist. Project developers do not need to wait for IRS to develop new guidance or regulations.

Legislative and Regulatory Details

The Inflation Reduction Act added section 48E(d)(1) which states:

Certain progress expenditure rules made applicable. Rules similar to the rules of subsections (c)(4) and (d) of section 46 (as in effect on the day before the date of the enactment of the Revenue Reconciliation Act of 1990) shall apply for purposes of subsection (a).

The final IRS regulations for the tax credit at 26 CFR 1.48E-4(g) makes it clear that qualified progress expenditures are now available:

Qualified progress expenditure election. A taxpayer may elect, as provided in § 1.46-5, to increase the qualified investment with respect to any qualified facility or EST of an eligible taxpayer for the taxable year, by any qualified progress expenditures made after August 16, 2022.

Following the link to 26 CFR 1.46-5 leads to the pre-existing regulations for qualified progress expenditures. This is what the IRA text refers to as “similar rules… of subsection 46… as in effect on the day before the enactment of the Revenue Reconciliation Act of 1990”. Key quotes from these regulations:

In general, qualified progress expenditures are amounts paid (paid or incurred in the case of self-constructed property) for construction of progress expenditure property…

The taxpayer must reasonably estimate that the property will take at least 2 years to construct and that the useful life of the property will be 7 years or more…

These existing regulations outline more key details including definitions, rules for self-constructed property, for non-self-constructed property, for partnerships and S corporations, record keeping requirements, and key examples for each.