Monday evening the Senate Finance Committee released their version of updated language that would change and repeal many of the tax credits enacted by the Inflation Reduction Act (IRA) of 2022, among other changes.

While this version improves upon the House-passed HR1, it eliminated a small tax provision that would have outsized impacts on nuclear, geothermal, hydropower, long-duration energy storage and other large, high-risk, capital-intensive projects.

MACRS tax benefits

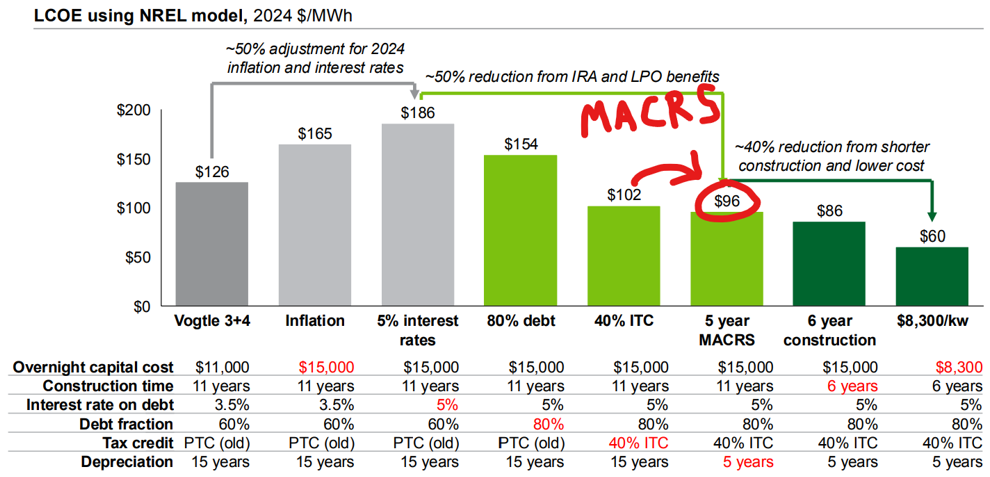

The tax benefit is called the Modified Accelerated Cost Recovery System (MACRS) and it allows taxpayers to condense depreciation of capital expenditures for certain projects from 15 years or longer down to just 5 years. Given the time value of money, being able to take advantage of these tax benefits faster results in more value for project sponsors.

MACRS benefits are separate from and in addition to any other tax credit. Unlike tax credits however, MACRS benefits cannot be transferred and can only be claimed by the owner of the project or claimed through tax equity partnership deals.

This means the value of MACRS is especially important for large scale capital-intensive projects that are unlikely to be able to take full advantage of tax credit transfer: nuclear, geothermal, and new hydropower. As the value of MACRS is directly proportional to the capital spend, higher capital projects get more value from MACRS. These technologies are less mature and higher risk – therefore their tax credits would likely trade at a steep discount on the tax credit transfer market. Many project sponsors would likely instead look to the tax equity market to find additional investors who could fully monetize MACRS and the tax credits.

The quantified value of MACRS is significant for these projects. Using analysis from DOE’s Advanced Nuclear Liftoff Report shows that MACRS for a new AP1000 nuclear reactor is worth 6% of the levelized cost of electricity. Again, this benefit is in addition to value from the tax credits.

Senate bill text would immediately end MACRS

The Senate Finance Committee bill text section includes Section 70509 which would end MACRS eligibility for “any property placed in service after date of enactment of this Act.” This is bad and counter-productive.

Projects currently under construction that were planning on MACRS eligibility would have the rug pulled out from their economics. IRA Section 13703 enabled broader MACRS eligibility for all projects eligible for the clean electricity tax credits that are placed in service in 2025 or later, so there are certainly projects already being constructed that are planning on using MACRS and would be blindsided by an immediate end to to eligibility.

It also disproportionally affects the technologies that the bill otherwise maintains support for. As noted above, MACRS is most useful for nuclear, geothermal, hydropower, and long-duration energy storage. These are the exact technologies that the bill otherwise maintains broader tax credit eligibility for so it is counter productive to at the same time end MACRS eligibility for those same technologies.

Finally – there’s not much budget savings to eliminating this provision. The original 2022 Joint Committee on Taxation estimate of MACRS budget cost from IRA enactment was only a couple hundred million dollars over ten years. That estimate included the effect of wind and solar projects using MACRS, so it is reasonable to assume that the actual budget impact of keeping MACRS in the current proposal would be significantly less.

If Congressional Republicans are serious about supporting nuclear, geothermal, and other key power generating technologies, eliminating section 70509 from the bill and keeping MACRS eligibility is simple change with outsized impact.