Nuclear gets new – but oddly narrow – tax credit bonus in the Republican’s tax and spending law

The recently enacted HR1 – One Big Beautiful Bill Act (somehow combining contradictory terms “bill” and “act” in the same title) is estimated to have significant economic impacts: reducing energy deployment when demand is growing, increasing energy costs for consumers, and adding $3.4 trillion to the national debt.

But! Maybe some silver linings for the nuclear industry, as they maintain many of the incentives originally enacted by the Inflation Reduction Act (IRA) of 2022, including access to the clean electricity tax credits, tax credit transfer, and accelerated depreciation.

HR1 actually expands upon one of the IRA’s bonus tax credit programs, so that it more explicitly include nuclear. However on closer look, the new “nuclear energy community” bonus tax credit has so many limitations that it’s ultimate impact and underlying intention is unclear.

Inflation Reduction Act’s “Energy Communities” Bonus

First, a look back at the already existing program. The IRA created an “Energy Communities” bonus available to both the clean electricity production tax credit (PTC) and the investment tax credit (ITC) worth 10% and 10 percentage points respectively. New clean electricity and energy storage project located in areas near closed coal power plants or mines and in areas with large amounts of fossil fuel workers were eligible for the credit. It was designed to encourage economic investment in these communities.

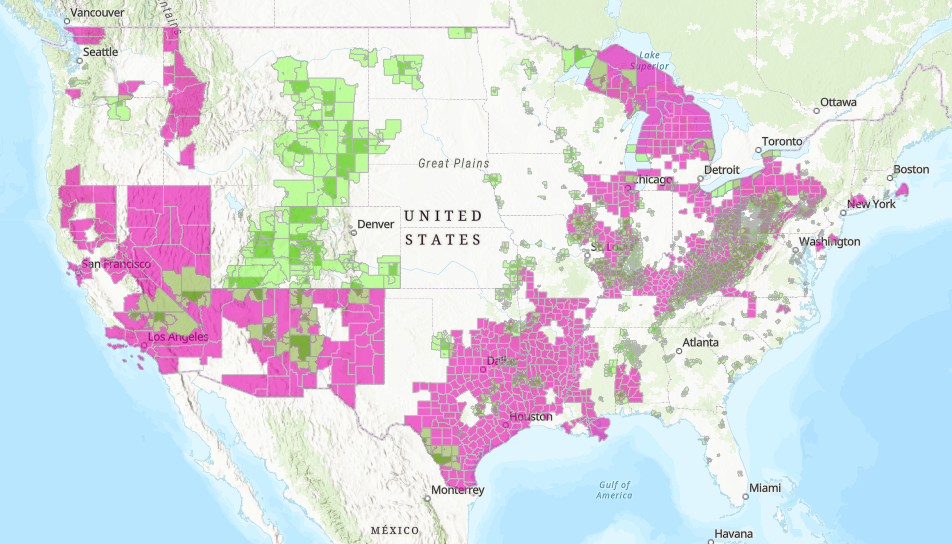

These eligible areas are spread across the country in expected areas as seen in the map below – Appalachian and coal producing regions in the west, as well as small clusters around closed coal plants scattered around the country in green, and areas with high levels of fossil fuel industry employment and unemployment in purple. (See interactive version here)

The theory behind the energy communities bonus is sound: preferentially support energy investment in communities that have been affected by closures of fossil fuel energy infrastructure and that have borne the brunt of associated pollution from hosting this infrastructure.

Nuclear host communities face similar economic challenges

However, IRA’s energy communities bonus was limited to only fossil fuel closures. Communities that have historically hosted nuclear reactors that have retired have faced similar economic challenges in the wake of reactor retirements.

Nuclear plants are typically large employers in relatively rural regions and cause an economic shock to local communities when they retire. Twelve nuclear plants retired closed in the 2012 – 2021 period and communities are still feeling the economic impact.

For example, when Vermont Yankee closed in 2014 the host community of Vernon, VT experienced significant economic impacts:

It took more than 600 workers to operate Vermont Yankee. Their average salary was over $100,000 a year — two-and-a-half times the typical job in the region — with a total payroll around $70 million a year.

“The biggest impact obviously that happened on the town was financial,” says Josh Unruh, chair of Vernon’s select board. “We lost several hundreds of thousands of dollars in property tax revenue, and for a town of 2,200 people that’s a huge hit.”

Creating a new provision to help drive economic reinvestment into these communities makes sense and would be a logical extension addressing a gap in the design of the existing energy communities bonus credit.

Enter New “Nuclear Energy Communities”

HR1 now creates a new way to qualify for the 10% energy communities bonus by adding a category for “Nuclear Energy Communities.” At first glance, I assumed this was intended to achieve the same goal – to encourage economic development in communities that previously had hosted nuclear energy infrastructure.

However, that is not what this provision does – it appears to be extremely narrowly targeted at supporting plant restarts and new AP1000 and small modular nuclear deployed at existing sites, with some major limitations in flexibility.

First, the credit is only available for “advanced nuclear facilities,” significantly limiting the impact as communities do not have flexibility in pursuing different options for economic development. For example, building a new battery energy storage facility near a closed nuclear reactor isn’t eligible.

Second, eligibility is determined based only on having a historical employment in the advanced nuclear industry above a minimum 0.17% threshold. Unlike for fossil fuel energy communities, there is no way to qualify simply by having a recently retired reactor.

In some ways, this is an improvement over the existing criteria for qualifying as a fossil fuel energy community which required both having met a historical employment threshold AND having unemployment greater than the national average in the prior tax year. That unemployment criteria could change tax year to tax year causing a given location to change eligibility, giving a significant amount of uncertainty to project developers.

On the other hand, without the ability to qualify simply by having a closed nuclear reactor means that possible energy communities are not going to have any certainty on whether they qualify until IRS completes its analysis and issues new guidance. Which could be… awhile

Relatedly, definition of “advanced nuclear” (which applies to determining the eligibility of both the project seeking to be eligible for the tax credit and to the locations with historical nuclear employment) is not certain to even include locations that have had reactor retirements. It’s unclear that any of the communities that have had closed nuclear reactors since 2009 would even qualify as an “advanced reactor” under this definition. For example, the Vermont Yankee reactor discussed above began operations in 1972 – making it difficult to understand if it would qualify as an “advanced” nuclear facility. IRS interpretation will be critical here.

Finally and maybe most impactfully – the bonus is only available for the PTC and not for the ITC. This severely limits the types of projects that will benefit from this. The ITC, with a 10 percentage point bonus for a total of up to 40%, is expected to be more valuable to high capital expenditure projects like first of a kind small modular reactors and large reactors like the AP1000.

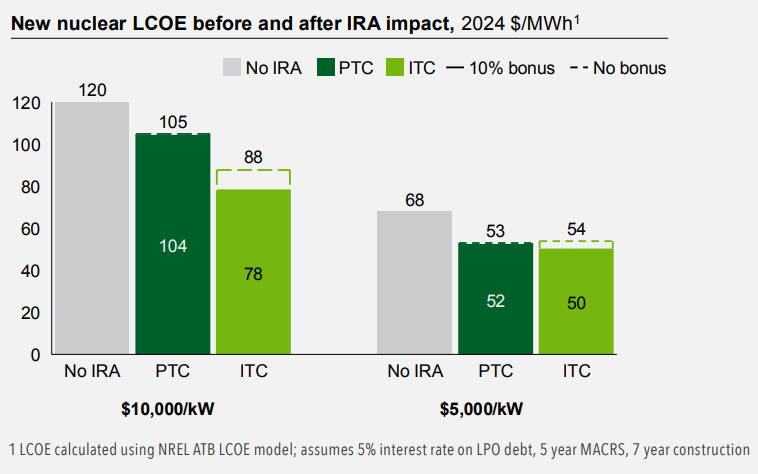

As shown in the figure on PTC vs. ITC cost impacts form the DOE Advanced Nuclear Liftoff Report below, the ITC generally wins out for new reactors. While the PTC is likely more valuable for nuclear restarts like Palisades in Michigan, there are only a handful of restart projects possible (Crane Clean Energy Center nee Three Mile Island in PA, and the Duane Arnold plant in IA) and it’s unclear why Congress would limit flexibility for nuclear developers in this way.

So… who is the credit for?

In summary – the bonus credit will not drive huge investments into historical nuclear host communities, it’s not clear communities with closed reactors will even qualify, and it’s not particularly useful to new high capital cost AP1000 or small modular reactors because they can’t use it with the ITC. It might be useful for the handful of possible nuclear restarts, but two of the three possible restarts are already underway so this will end up being a windfall for developers.

So… who is this for?