The Senate Finance Committee updated version of language that would change and repeal many of the tax credits enacted by the Inflation Reduction Act (IRA) of 2022, would maintain the Investment Tax Credit (ITC) for key technologies including nuclear, geothermal, long-duration energy storage, and hydropower.

The ITC is a key driver of technology investment, allowing taxpayers to receive 30 to 50% of the total investment back in tax credits. However, this one arcane tax rule prevents regulated utilities from fully realizing the value of the ITC and places them at an unfair disadvantage relative to unregulated developers. This is especially important for nuclear, given regulated utilities role in owning and operating large nuclear power plants – think Southern Company or Duke Energy.

Republicans in Congress have the opportunity to make a tweak to tax rules, enable regulated utilities to realize the full value of the ITC for new big projects like nuclear power, and lower energy costs for consumers at the same time.

Normalization Tax Rules

The tax rule in question is called “normalization” and it applies only to regulated entities like utilities. In short, normalization requires those utilities to spread a one-time tax benefit (like the ITC) over the lifetime of the asset (e.g. 20 to 30 years) rather than have it immediately used to lower rates for consumers. For further reading on the details and background on normalization rules, here is a good overview from Viewpoint.

This limits the utilities’ ability to fully realize the value of the ITC and limits the customers from seeing the full impact of the ITC on their bills as it is spread out over time. Due to the time value of money, this erodes the value of the ITC to both the utility and the consumer. As noted above, a third party independent power producer does not face such restrictions and as such is at an inherent advantage to a regulated utility, all else being equal for an equivalent power project.

Opt-Out of Normalization Rules Already Exist – But Only for Energy Storage

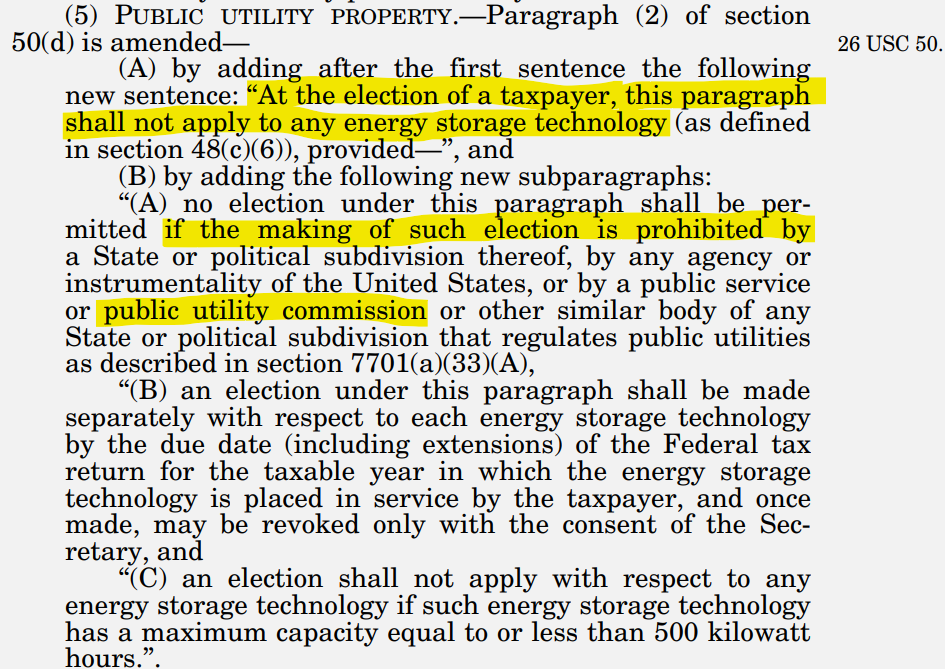

In the IRA section 13102, Congress already developed a normalization opt-out mechanism for the ITC but narrowly only applied it to energy storage technologies.

This provision gives utilities the option to opt out of using normalization rules, but only if the relevant state agency or public utility commission does not prohibit it.

Ultimately, this mechanism removes the federal restriction the requires normalization, gives utilities more flexibility in deciding how best to realize the full benefit of the ITC, and still keeps state regulators in the driver’s seat for deciding what is best for consumers. But crucially it only applies to ITC earned on energy storage technologies.

Enabling Normalization for All Technologies Benefits Nuclear Deployment and Consumers

Congress now has the opportunity to extend this normalization opt out to all other technologies that are eligible to earn the 48E ITC, which would include nuclear, geothermal, and hydropower facilities.

Utilities themselves have recognized the value of normalization opt out in speeding development of new power sources and technologies, such as Duke Energy noting millions of dollars of savings for customers when using the ITC to expand a pumped-hydro storage facility. Nuclear analysts at the Nuclear Innovation Alliance have identified in particular how allowing ITC normalization opt-out for nuclear and other technologies can speed capital deployment.

Finally from a budget perspective – changing these rules should have minimal to no effect on the federal budget. The normalization rules do not change when the ITC impacts the Treasury, only in how the regulated entity can use those tax benefits.

Changing this rule should be a low- to no-budget way for Republicans in Congress to make ITC use more efficient, further support new technologies like nuclear, and lower costs for rate payers.