It’s no surprise: demand for electricity is growing again for the first time in over a decade. Power is urgently needed to support the expansion of data centers, major manufacturing facilities, and support strategic economic sectors like AI and semiconductors.

What is surprising is that Republican’s HR1 bill that recently passed the House of Representatives would directly undercut the power projects that could actually be deployed within the next five years, weakening our ability to power investments in AI and manufacturing.

The ability to deliver new natural gas power in the next few years is limited

Advocates for repealing the existing tax credits for clean electricity and energy storage projects say that natural gas will be able to scale rapidly to meet the urgent needs of new data center and manufacturing load and support grid reliability. However, the power sector and gas turbine manufactures themselves outline the limitations on rapid expansion.

In a call with investors earlier this year, NextEra CEO John Ketchum outlined the issue, highlighting the timing mismatch between demand and how fast new gas generation can be brought online:

“With gas-fired generation, the country is starting from a standing start. And we’ve got to go find the sites, we’ve got to develop these sites, we’ve got to get gas to those sites. We’ve got to get hands on gas turbines. If you take all those things together and you think about when is gas really going to be able to contribute at scale, I mean, we’re… looking at 2030.”

Despite recent announcements of investments aimed at expanding gas turbine manufacturing capabilities, the amount of new natural gas power generation that can be developed within the next few years is generally going to be limited to what is already planned.

Not only will it will take time to scale up manufacturing of gas turbines, as reported by Heatmap News, turbine manufacturers themselves are hesitant to overcommit capital in the event demand is not as robust as predicted:

“But over the longer term, it looks like GE Vernova is intentionally committing more to capital discipline rather than to broader capacity expansion. The company has $1.7 billion in free cash flow, a third of which it will return to shareholders through dividends and stock buybacks. And [GE Vernova CEO Scott Straznik] wants to avoid using the rest to underwrite what he sees as dangerous overcapacity that could threaten GE Vernova’s profitability.

“I think we have to be very thoughtful to make sure that we don’t add too much capacity, even though we are starting to sell slots into 2029,” he said during the investor update.

Power resources already deploying at scale are a critical source of new energy and capacity

In his remarks to investors, Ketchum makes the key point that data center developers and other manufactures prize speed to deployment above all else. Logically this implies federal policy should also work to accelerate those resources that are already deploying at scale.

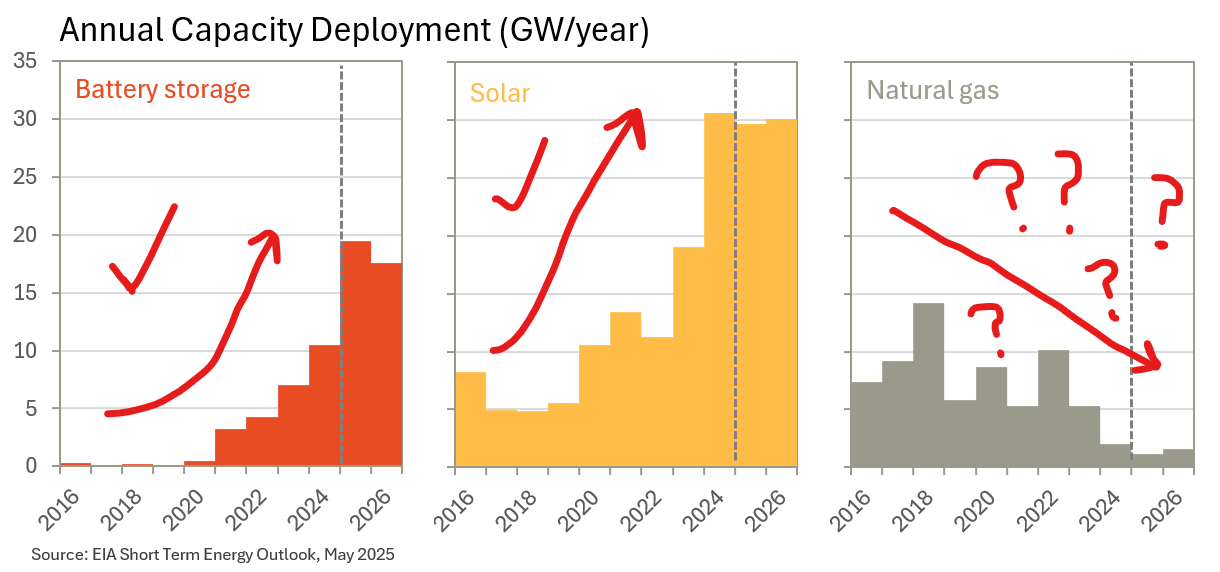

For example, solar and battery energy storage systems have been ramping up deployment over the last few years with dramatic increases in 2024 and 2025, as tracked and projected by the U.S. Energy Information Administration (EIA) and shown below. Battery energy storage could get close to 20 GW deployed this year after having a handful of megawatts deployed as recently as 2020. Solar for years hovered in the 5-10 GW per year deployment range, but now is on track to maintain 30 GW per year from 2024 through 2026.

These industries are ready to scale, having spent the last half decade laying the ground work, training the workforce, developing the projects, and securing the supply chains. This ramp-up in deployment is no accident. It is a direct result of the tax incentives and investments in the Inflation Reduction Act of 2022, the Infrastructure Investment and Jobs Act of 2021, and associated targeted industrial policies of the Biden administration.

Weakening solar and battery energy storage deployment threatens power reliability

The most problematic provisions in HR1 are the ending of the investment, production, and advanced manufacturing tax credits (Tax sections 48E, 45Y, and 45X respectively) and tax credit transferability (section 6418) for projects that begin construction after 60 days post-enactment. This would change the underlying tax rules for projects currently in development, likely making many of them uneconomic and leading to a slew of project cancellations or delays.

These projects are critical to supporting economic growth and grid reliability. For example, the North American Electric Reliability Corporation (NERC) confirms that rapid battery deployment coupled with solar in key regions are a major factor in providing reliable capacity and reducing the risk of power outages.1 From their recent 2025 Summer Reliability Risk Assessment discussing the change since the prior year’s assessment for the Texas grid operator, ERCOT:

“ERCOT’s probabilistic risk assessment of energy emergency alert (EEA) likelihood for the highest risk periods associated with evening hours in the peak month of August is projected to fall to 3%, down from over 15% in 2024.

Lower risk is attributed to a nearly doubling of battery energy storage capacity and improved energy availability from new battery storage and operational rules.”

Deployment of solar and storage is already helping the grid, increasing reliability, and helping to power expansion of key industries.

HR1 unnecessarily imperils our ability to power new industries

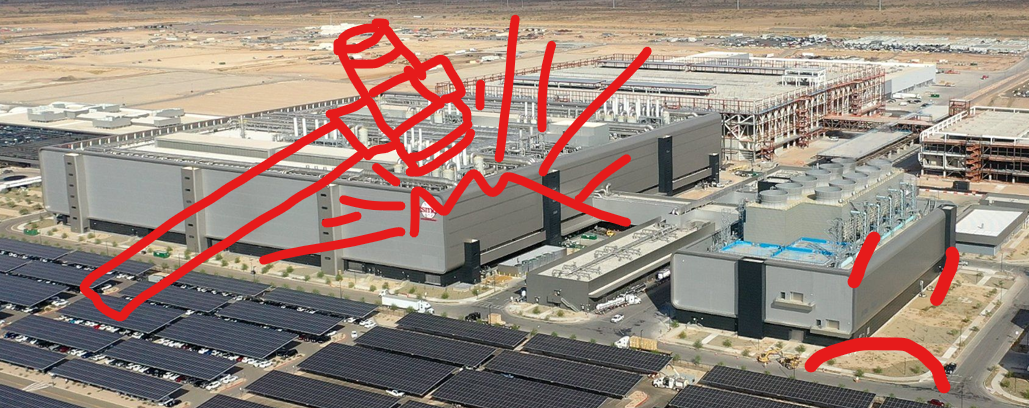

Data center developers already demonstrate the importance of solar and storage to powering AI. The 5 GW Stargate projects announced with much fanfare earlier this year is reported to rely on solar and energy storage. Companies like Google are already directly using solar power to run their data centers, like this 850 MW project in Texas by SB Energy, which is supported by the Inflation Reduction Act tax credits with extra bonuses for using domestically manufactured equipment.

Republican’s choice with HR1 seems clear: Keep the tax credits and give industry the certainty to rapidly expand, support powering domestic growth in strategic industries, improve the reliability of the power system, and maintain billions of dollars of investments.

Or cut the credits and see data center and other advanced manufacturing projects evaporate.

Maybe Republicans are content to see these kinds of investments go to UAE instead.

- The version of HR1 that passed the House includes an exception for nuclear projects. Those would still be eligible for projects beginning construction by the end of 2028. ↩︎