The House Ways and Means proposal is especially bad for new nuclear. Combined with other proposals to rescind funds from DOE’s Loan Program Office, the changes here would effectively kill any momentum for new domestic nuclear deployment. A few key impacts:

- Nuclear capital costs would immediately increase 30% to 50% as no project will be eligible. The current technology-neutral investment tax credit (48E) provides eligibility to projects that commence construction by the deadline. The proposed text would change eligibility to commence operations in 2028 before a phase down. Despite some promising starts, there is no new nuclear project that will be operational by 2028, so no new nuclear will be eligible for the 30% to 50% investment tax credit.

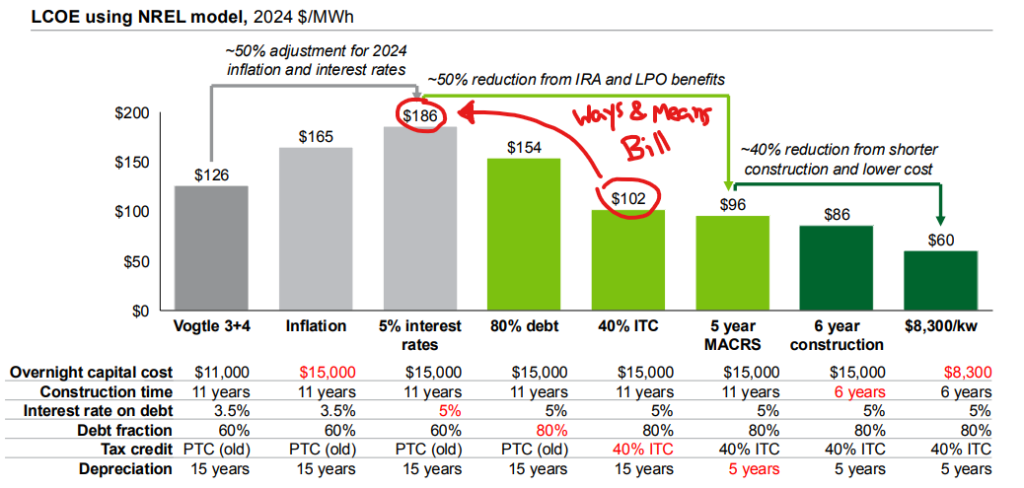

- Project financing will soar with recission of available DOE Loan Program Office (LPO) funds. LPO provides low cost loans to support first of a kind projects that otherwise either could not get a commercial loan or could only get a loan with a higher interest rates. Given the large capital costs and long construction timeline of new nuclear, even a small increase in interest rates would lead to huge increases in overall project costs.

- Removing tax credit transferability effectively negates any benefit of the tax credit phase out. Transferability allows project developers to sell tax credits and avoid complicated and expensive tax equity deals. The proposed changes would begin to phase tax credit amount out starting with a 20% reduction in credit for projects completed in 2029, and fully expiring in 2032. However, without the ability to transfer tax credits, nuclear developers would need to secure more expensive tax equity financing. This makes the phased out tax credits essentially worthless to nuclear developers, who would rather secure debt financing at lower cost and complexity.

- Tying tax credit eligibility to commercial operations creates bad incentives structures and dramatically increases risk. Nuclear projects, especially first of a kind, generally run long and over budget. Adding a commence operations deadline for eligibility creates a bad structure where now safety is directly at odds with federal incentives. Would a project put safety at risk in order to rush completion to get the 30% investment tax credit?

- This kills the only existing federal cost-overrun insurance program for nuclear. The existing investment tax credit applies 30% to 50% to the eligible investment in the project. This applies to the total investment, regardless of whatever the initial budget estimate was. In effect, this means the US Treasury would cover 30% to 50% for cost-overruns for new nuclear through this tax credit. Rescinding this would remove the only existing cost-overrun program for nuclear, raising risk and financing costs.

An illustrative impact of the possible impact of these on project costs shows that lack of LPO financing and tax credit eligibility alone could almost double the levelized cost of energy for a new AP1000 plant.

Other remaining nuclear programs are not sufficient to fill the gap. For example, TVA is arguably closest to deploying a small modular nuclear reactor (SMR) with a site and a technology partner already chosen. They’ve applied for DOE’s $800 million Generation III+ Small Modular Reactor program, designed to accelerate deployment of new nuclear technologies. However, TVA itself said in a press release the funding would only slightly accelerate deployment:

If awarded… the funding will accelerate construction of an SMR at TVA’s Clinch River Project, in Oak Ridge, Tenn., by two years – with commercial operation planned for 2033.

Even with DOE funding accelerating the timeline, TVA would not come close to qualifying for the tax credits, nor would $800 million replace the 30% or more of total costs in tax credits that TVA would be eligible for under existing law.

Nuclear project developers need policy certainty to build out an orderbook of projects. The proposed changes ultimately change the rules of the game for nuclear developers and investors just when approaching final investment decisions. Without the certainty of tax credits and other federal financing tools, projects are going to be significantly more expensive, or might not happen at all.